The deepwater Gulf will remain a cornerstone of U.S. domestic energy portfolio for "many years to come," Acting Assistant Secretary for Land and Minerals Management and Bureau of Ocean Energy Management Director (BOEM) Tommy Beaudreau praised after the results of Central Gulf of Mexico Lease Sale 227.

Central Gulf of Mexico Lease Sale 227 garnered total bids of $1.6 billion and high bids of $1.2 billion. Fifty-two oil and gas companies took part in Lease Sale 227, which Gulf of Mexico Regional Director John Rodi said ranked in the Top Ten of lease sales in terms of high bids since leasing began in 1983.

Beaudreau thanked the oil and gas industry for its continued interest in the central Gulf, and Rodi said the recent drilling success seen in the Gulf indicates the present and future value of the Gulf of Mexico.

Statoil Gulf of Mexico LLC and Samson Offshore LLC bid $81.8 million for Walker Ridge Block 271, the highest bid received in the lease sale.

Bidding results presented a significant indication of continued interest in the deepwater Gulf. Rodi attributed the interest in deepwater to new seismic data that has been made available and successful drilling results seen in the Gulf of Mexico over the past year. The focus on the deepwater Gulf – which is more costly and requires more focus on exploration and development plans – may be a reason for a lower level of bidding seen since the previous lease sale.

BOEM received 407 bids submitted by 47 companies on 320 offshore blocks in Central Gulf of Mexico Lease Sale 227. The sale acreage includes 7,299 blocks and covers approximately 38.6 million acres, located from three to about 230 nautical miles offshore in water depths ranging from 9 to over 11,115 feet (3 to 3,400 meters).

BOEM estimates the lease sale could result in the production of .46 billion to .89 billion barrels of oil, and 1.9 trillion cubic feet to 3.9 trillion cubic feet of natural gas.

BP plc did not directly submit bids in Wednesday morning's sale, but might have possibly partnered on a bid. BP was permitted to bid in the lease sale, but due to a suspension imposed last November by the U.S. Environmental Protection Agency from obtaining new oil drilling leases and other new contracts with the federal government, the company would not have been awarded a lease.

Despite its decision not to participate in the lease sale, the company intends to continue investing at least $4 billion annually in the region over the next decade, maintaining its position as the largest investor and leaseholder in the region. BP holds leases on nearly 700 Gulf of Mexico blocks, and currently has seven rigs operating in the Gulf. The deepwater Gulf also remains a core area for BP globally.

"We hope we can reach a reasonable resolution with regulators so that America's top energy investor over the past five years can once again enter into new contracts with the U.S. government," said Geoff Morrell, BP's head of U.S. communications, in an email statement to Rigzone.

Secretary of the Interior Ken Salazar called the lease sale a "historic day" and part of the Department of the Interior's (DOI) plan to implement President Obama's "all of the above" energy strategy. However, preliminary sale information indicates the number of tracts and acres receiving bids is down almost 30 percent versus last year's offering and nearly 40 percent compared with the average of the prior five sales, according to a March 19 analyst note from GHS Research.

GHS Research analysts attributed the decline to:

a 16 percent reduction in participants versus the 2012 sale and a 37 percent decline compared with the average of the prior five salesan 18 percent decline in the number of bids per participant versus last year and a 23 percent decline relative the previous five sales

Pent-up demand also may have been a factor in the higher level seen in the previous central Gulf lease sale since it was the first following the 2010 Macondo incident. Central Gulf Lease Sale 216/222, held in June 2012, resulted in $2.6 billion in total bids and $1.7 billion in high bids. Fifty-six companies bid on 454 blocks out of the 7,434 blocks that were offered.

"I do think there is a significant amount of acreage already under lease and robust exploration activity underway throughout the Gulf of Mexico," Salazar said in an earlier conference call with reporters Wednesday, noting that more rigs are operating in the Gulf of Mexico today before the Macondo incident in 2010.

Seventy-one jackups, semisubmersibles and drillships are under contract in the Gulf of Mexico as of March 20, up slightly from the 70 rigs under contract as of April 19, 2010, according to data from Rigzone's RigLogix database. Thirty-eight semisubs and drillships are currently under contract in the region, up from 34 under contract as of April 19, 2010.

Operators' sharpened focus on the Gulf's deepwater acreage also may be another factor in the lower level compared to the previous central Gulf sale.

"Companies may not bid as much but they hone in on selective acreage," said Beaudreau.

Since Macondo, DOI has undertaken an unprecedented overhaul of federal oversight into federal exploration and raised standards, Beaudreau commented.

"We've raised standards with respect to industry, and this activity is conducted more safety and responsibly," Beaudreau told reporters. "We've seen the benefits of that with strong investment in the Gulf of Mexico."

BOEM has been able to raise these standards thanks to funding that has allowed the agency to hire additional staff. The additional workers have not only allowed BOEM to implement heightened standards, but increase the efficiency and speed of the plan review and permitting process while not cutting corners.

"We've seen tremendous progress over the last year and a half," Beaudreau told reporters in a conference call. "The fundamental lesson we drew from the MMS [Minerals Management Service] was that it was a severely underfunded agency."

However, Beaudreau fears that the sequester – which means that BOEM staffers now have limited overtime – may prolong the time period on plan reviews.

"The BOEM and BSEE [Bureau of Safety and Environmental Enforcement] are can do agencies, but now we have the fiscal constraints we have to continue with," Beaudreau said, calling the funding limits imposed by the sequester "an extremely unfortunate situation."

Salazar said he was proud of the fact that the United States now imports less than 40 percent of the oil it consumes – a dramatic change from a few years ago. He noted that that a member of Iraq's oil ministry was on hand for the lease sale to learn more about the U.S. resource bidding process.

While BOEM recently announced plans for wind energy development offshore Virginia, no mid or south-Atlantic acreage is scheduled for bidding at this time. Beaudreau said BOEM has been working with the Department of Defense to identify offshore areas where military traffic might conflict with future oil and gas exploration. BOEM announced March 14 that a wind energy research lease was issued to Virginia's Department of Mines Minerals and Energy.

GHS anticipates a shift from exploration to development drilling to monetize discoveries such as Anadarko's recently announced Shenandoah-2 results in the deepwater Gulf of Mexico, which hit over 1,000 feet of net oil pay in multiple high-quality Lower Tertiary-aged reservoirs, will pick up following nearly a 70 percent/30 percent exploration/development split in recent years, "thus we are neither surprised nor concerned with a weak showing for new exploration."

Industry associations praised the lease sale results, but called for new areas of the U.S. Outer Continental Shelf (OCS) to be opened for exploration.

National Ocean Industries Association (NOIA) President Randall Luthi said the enthusiasm evident in the sale "confirms a continuing positive trend for the offshore industry in the Gulf of Mexico" and a reminder that offshore oil and natural gas resources are vital to the United States' "all of the above energy strategy".

However, NOIA believes the "all of the above" energy strategy should apply to areas where exploration currently is not allowed, and that greater access should be allowed to the 85 percent of the OCS currently not available for leasing, Luthi commented in a statement. A lack of modern seismic data leaves the industry guessing as to its true resource potential, Luthi added.

"Opening new offshore areas will open the door to new jobs, energy, and even more revenue to the federal treasury which could be used to help reduce the federal deficit," Luthi commented in a statement.

Louisiana Mid-Continent Oil and Gas Association President Chris John said the inefficiencies of the federal 2012-2017 offshore plan cannot be ignored, despite the solid lease sale results.

"With a $77.3 billion impact on our state and over 300,000 jobs supported, the economic impact of the oil and gas industry on the state of Louisiana alone is incredible," John said in a statement.

"The Gulf of Mexico has a strong future as an attractive investment area for drilling activity and today's lease sale will create jobs and increase revenues for the state of Louisiana."

Karen Boman has more than 10 years of experience covering the upstream oil and gas sector. Email Karen at kboman@rigzone.com.

Generated by readers, the comments included herein do not reflect the views and opinions of Rigzone. All comments are subject to editorial review. Off-topic, inappropriate or insulting comments will be removed.

View the original article here

Governor Hickenlooper likes to paint himself as an outsider, unfamiliar with the political process. But his recent actions to undermine public health, water safety – and basic common sense – have proven that Gov. Hickenlooper has become the ultimate insider – adept at helping his billion dollar oil and gas industry boosters cheat the rules, while playing the role of concerned official.

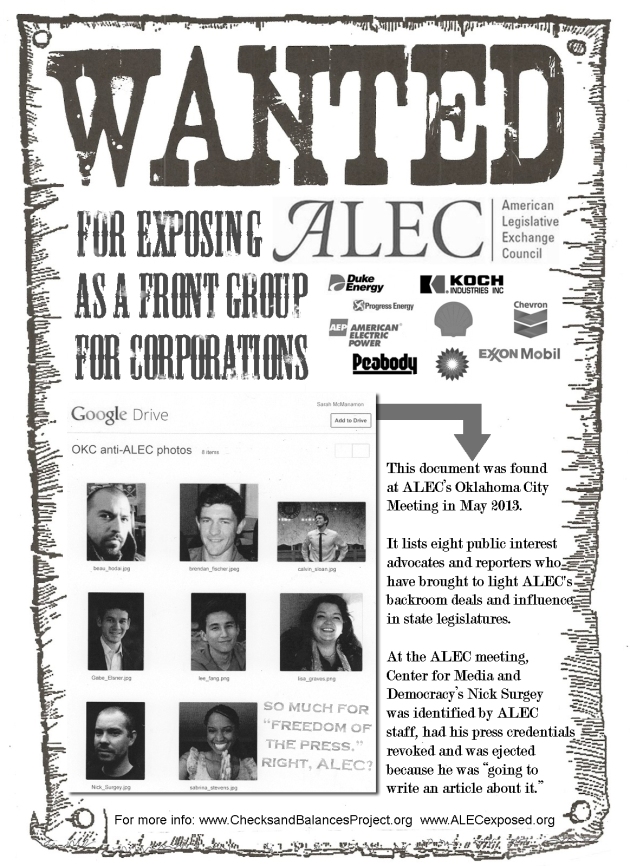

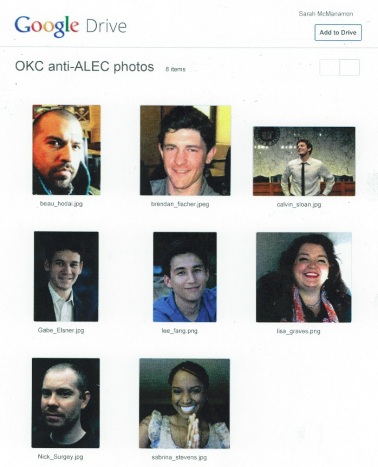

Governor Hickenlooper likes to paint himself as an outsider, unfamiliar with the political process. But his recent actions to undermine public health, water safety – and basic common sense – have proven that Gov. Hickenlooper has become the ultimate insider – adept at helping his billion dollar oil and gas industry boosters cheat the rules, while playing the role of concerned official. The Center for Media and Democracy’s (CMD) Brendan Fischer and Nick Surgey uncovered an internal document from the American Legislative Exchange Council (ALEC) at the controversial organization’s meeting last week in Oklahoma City. The document entitled “OKC anti-ALEC photos” featured the headshots of eight reporters and public interest advocates that have written about ALEC or been critical of ALEC’s activities (as a front group working on behalf of its corporate membership).

The Center for Media and Democracy’s (CMD) Brendan Fischer and Nick Surgey uncovered an internal document from the American Legislative Exchange Council (ALEC) at the controversial organization’s meeting last week in Oklahoma City. The document entitled “OKC anti-ALEC photos” featured the headshots of eight reporters and public interest advocates that have written about ALEC or been critical of ALEC’s activities (as a front group working on behalf of its corporate membership). As Fischer and Surgey point out, ALEC claims to support the freedom of the press. But in practice, the organization seems reluctant to provide transparency and access required for a free press to be functional. Instead, “ALEC assembled a dossier of disfavored reporters and activists,” and “kicked reporters out of its conference who might write unfavorable stories…”

As Fischer and Surgey point out, ALEC claims to support the freedom of the press. But in practice, the organization seems reluctant to provide transparency and access required for a free press to be functional. Instead, “ALEC assembled a dossier of disfavored reporters and activists,” and “kicked reporters out of its conference who might write unfavorable stories…”