Gary Gray, a former Woodside Petroleum Ltd. corporate affairs chief, has been named Australia's new Minister for Resources and Energy following a cabinet reshuffle of the country's governing Labor Party.

The West Australian replaces Martin Ferguson in the role.

Industry bodies have welcomed Gray to the position, but warned he would be challenged by Australia's ongoing issue of the rising cost of doing business in the country.

The Australian Petroleum Production and Exploration Association (APPEA) believed Gray's appointment, while a positive move for the industry, came at a crucial time in its history.

David Byers, APPEA chief executive, said the industry was presently investing $208 billion (AUD $200 billion) in new projects, including seven major liquefied natural gas (LNG) ventures.

He added the industry was at a turning point, with numerous new projects on the drawing board, but not yet committed.

"Australian oil and gas project costs are among the highest in the world and there are several critical policy areas that require genuine reform if hurdles that currently hinder the local industry's ability to compete internationally are to be removed," he said.

"Most important of these is the need for a stable, predictable and competitive taxation regime that encourages exploration and development investments.

"The oil and gas industry's long-term projects need long-term stability. Yet over the past five years the industry has been confronted with a range of disruptive changes to the taxation regime, affecting the company and resources taxation settings."

The Chamber of Minerals and Energy of Western Australia (CME) also applauded Gray's appointment to the portfolio.

Reg Howard-Smith, CME chief executive officer, said it was good news the important portfolio had been given to a Western Australian, given the state's resources sector accounted for 46 percent of Australia's export income.

"Policy initiatives that focus on reducing costs, duplication and red tape will deliver ongoing economic benefits to all Western Australians," Howard-Smith said.

"Unfortunately we are becoming a less attractive place to develop resources projects when compared with global resource rich nations and investment may be driven to other lower cost regions because of additional layers of taxation and charges, which are continuing to drive up cost for doing business."

Generated by readers, the comments included herein do not reflect the views and opinions of Rigzone. All comments are subject to editorial review. Off-topic, inappropriate or insulting comments will be removed.

Shot: Failure to open more federal lands to drilling will hurt job creation and economic growth in Western communities.

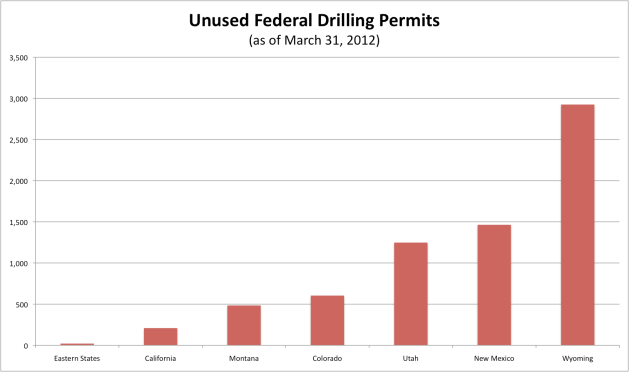

Shot: Failure to open more federal lands to drilling will hurt job creation and economic growth in Western communities. Adam Sieminski, U.S. House, Subcommittee on Energy and Power Committee on Energy and Commerce, 2 August 2012

Adam Sieminski, U.S. House, Subcommittee on Energy and Power Committee on Energy and Commerce, 2 August 2012 BLM Table of Average Application for Permit to Drill (APD) Approval Timeframes: FY2005 – FY2012

BLM Table of Average Application for Permit to Drill (APD) Approval Timeframes: FY2005 – FY2012 BLM Approve Permits – Not Drilled table

BLM Approve Permits – Not Drilled table DOI Oil and Gas Lease Utilization Report

DOI Oil and Gas Lease Utilization Report Generated by readers, the comments included herein do not reflect the views and opinions of Rigzone. All comments are subject to editorial review. Off-topic, inappropriate or insulting comments will be removed.

Generated by readers, the comments included herein do not reflect the views and opinions of Rigzone. All comments are subject to editorial review. Off-topic, inappropriate or insulting comments will be removed.