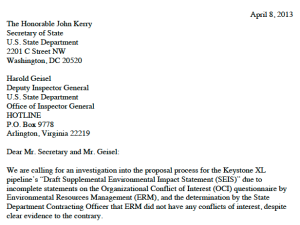

Letter to Secretary of State John Kerry and State Dept. Deputy Inspector General Harold Geisel

Originally posted on April 9, 2013.

Yesterday, Checks & Balances Project and 11 environmental, faith-based and public interest organizations called on Secretary of State John Kerry and the State Department Deputy Inspector General Harold Geisel to investigate whether Environmental Resources Management (ERM) hid conflicts of interest which might have excluded it from performing the Keystone XL environmental assessment and how State Department officials failed to flag inconsistencies in ERM’s proposal. Tom Zeller, Senior Writer at The Huffington Post, wrote an article highlighting the letter callings for an investigation.

Early last month, the State Department released a 2,000 page environmental impact study for the Keystone XL pipeline claiming that the pipeline would not have major impact on the environment. But, Environmental Resources Management (ERM), the consulting firm hired to perform the “draft supplemental environmental impact statement (SEIS),” has ties to fossil fuel companies with major stakes in the Alberta Tar Sands. This conflict of interest was not accurately disclosed in ERM’s answers on a State Department questionnaire. Checks & Balances Project considers ERM’s responses in its proposal to be intentionally misleading statements.

Unredacted Documents Uncover Conflicts of Interest

Last week, Mother Jones released unredacted versions of the ERM proposal, showing that three experts “had done consulting work for TransCanada and other oil companies with a stake in the Keystone’s approval.”

The unredacted biographies show that ERM’s employees have an existing relationship with ExxonMobil and worked for TransCanada within the last three years among other companies involved in the Canadian tar sands.

Here’s more from Mother Jones’ Andy Kroll:

“ERM’s second-in-command on the Keystone report, Andrew Bielakowski, had worked on three previous pipeline projects for TransCanada over seven years as an outside consultant. He also consulted on projects for ExxonMobil, BP, and ConocoPhillips, three of the Big Five oil companies that could benefit from the Keystone XL project and increased extraction of heavy crude oil taken from the Canadian tar sands.

Another ERM employee who contributed to State’s Keystone report — and whose prior work history was also redacted — previously worked for Shell Oil; a third worked as a consultant for Koch Gateway Pipeline Company, a subsidiary of Koch Industries. Shell and Koch have a significant financial interest in the construction of the Keystone XL pipeline. ERM itself has worked for Chevron, which has invested in Canadian tar-sands extraction, according to its website.”

When asked about who at the State Department decided to redact ERM’s biographies, a State Department spokesperson said “ERM proposed redactions of some information in the administrative documents that they considered business confidential.” Disclosing past clients may be business confidential information, but from what the biographies show, ERM may have recommended the redactions to hide conflicts of interest from public disclosure.

Problem with ERM Answers on Conflict of Interest Questionnaire

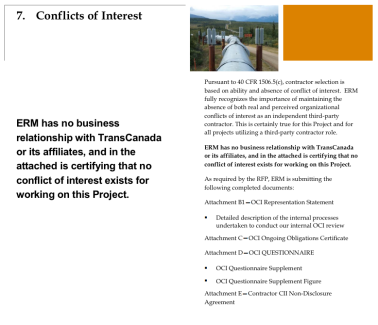

ERM’s Proposal to the State Department

The biographies on ERM’s proposal show that the company has had direct relationships with multiple business entities that could be affected by the proposed work in the past three years.

In the “Organizational Conflict of Interest Questionnaire,” the State Department asks (page 42), “Within the past three years, have you (or your organization) had a direct or indirect relationship (financial, organizational, contractual or otherwise) with any business entity that could be affected in any way by the proposed work?“ ERM’s Project Manager, Steve Koster, checked “No” but appears to have added to the Yes/No questionnaire that, “ERM has no existing contract or working relationship with TransCanada.”

Regardless of the addendum Koster added, he still submitted an incomplete statement when checking “No” to the specific question above. Simply put, the information provided by Mr. Koster was an incomplete statement if one simply reviews the biographies of ERM’s employees for the project.

The State Department Contracting Officer should have flagged this inconsistency when reviewing the staff biographies. ERM’s answers did not properly reveal in the Yes/No questionnaire that ERM did have a current “direct relationship” with a business enetity that could be affected by the proposed work and a relationship in the past three years with TransCanada, the company building the pipeline.

Koster’s incomplete statement on direct business relationships is not the only odd statement in ERM’s proposal. ERM also answered “No” to the question, “Are you (or your organization) an ‘energy concern?’” which the State Department defines (in part) as: “Any person — (1) significantly engaged in the business of conducting research…related to an activity described in paragraphs (i) through (v).” Paragraph (i) states: “Any person significantly engaged in the business of developing, extracting, producing, refining, transporting by pipeline, converting into synthetic fuel, distributing, or selling minerals for use as an energy source…” ERM as a research firm working for fossil fuel companies is, unequivocally, an energy interest.

So the question must be asked: If ERM is unable to accurately fill out a simple questionnaire regarding conflicts of interest, how can we trust the company to perform an unbiased environmental assessment of a 1,179 mile-long pipeline cutting through the American heartland? And, why did the State Department’s Contracting Officer not flag the inconsistencies in ERM’s Conflict of Interest Questionnaire when reviewing the proposals?

So the question must be asked: If ERM is unable to accurately fill out a simple questionnaire regarding conflicts of interest, how can we trust the company to perform an unbiased environmental assessment of a 1,179 mile-long pipeline cutting through the American heartland? And, why did the State Department’s Contracting Officer not flag the inconsistencies in ERM’s Conflict of Interest Questionnaire when reviewing the proposals?

Intentions of State Department and ERM in Question

The Federal Government has strict ethics rules to prevent Organizational Conflicts of Interest (OCIs) from impacting the impartiality of government contracts and to prevent hiring contractors who cannot provide independent and unbiased services to the government.

According to a white paper from the Congressional Research Service, before the State Department could choose ERM as the contractor, the “Contracting Officer” had to make an “affirmative determination of responsibility.” All government contractors (including ERM) must be deemed responsible, in part by meeting strict ethics guidelines, known as “collateral requirements.”

According to current collateral requirements, contractors must be found “nonresponsible” when there are unavoidable and unmitigated OCIs. Checks & Balances Project believes that the Contracting Officer should have deemed ERM “nonresponsible” because the company serves as a contractor for major fossil fuel companies that have a stake in the Keystone XL pipeline. If ERM were “nonresponsible”, the company would have been ineligible to perform the environmental impact review of the Keystone XL pipeline.

These potential material incomplete statements on a Federal Government proposal calls into question the integrity of ERM and threatens millions in government contracts.

If ERM were determined to be “nonresponsible” or “excluded” because of these incomplete statements, it could jeopardize ERM’s ability to perform any work for the Federal Government. Again, according to the Congressional Research Service:

“Decisions to exclude are made by agency heads or their designees (above the contracting officer’s level) based upon evidence that contractors have committed certain integrity offenses, including any “offenses indicating a lack of business integrity or honesty that seriously affect the present responsibility of a contractor.””

Certainly these incomplete statements call into question both the independence of ERM and the judgement of the Contracting Officer in making the “affirmative determination of responsibility.” This proposal process should be investigated by the State Department Inspector General to determine if ERM’s statements are cause for exclusion.

Groups Calling for Inspector General Investigation

We believe ERM used multiple material incomplete statements and had clear conflicts of interest as shown in the unredacted documents. So, why was ERM hired by the State Department?

Checks & Balances Project asked a State Department spokesperson about the conflicts of interest and the spokesperson said: “Based on a thorough consideration of all of the information presented, including the work histories of team members, the Department concluded that ERM has no financial or other interest in the outcome of the project that would constitute a conflict of interest.” Perhaps the State Department’s Contracting Offier made the decision to hire ERM because of the company’s incomplete statements on the conflict of interest questionnaire.

\ABS\Auto Blog Samurai\data\Land Rigs\checksandbalancesproject\80a23e5d-3b08-47e9-9c90-68466e287b45.jpeg)

Harold Geisel, Deputy Inspector General, U.S. State Department

Checks & Balances Project along with 11 other groups (Better Future Project, Center for Biological Diversity, Chesapeake Climate Action Network, DeSmogBlog, Forecast the Facts, Friends of the Earth, Greenpeace, NC WARN, Oil Change International, Public Citizen’s Energy Program and Unitarian Universalist Ministry for Earth) sent a letter to Secretary of State John Kerry and the State Department Deputy Inspector General Harold Geisel calling for an investigation into the matter. These incomplete statements and the determination by the Contracting Officer that ERM did not have any conflicts of interest, despite clear evidence to the contrary, are grounds for further investigation.

Filed under KeystoneXL Tagged with Andrew Bielakowski, Andy Kroll, Better Future Project, Big Oil, BP, Center for Biological Diversity, Checks and Balances Project, Chesapeake Climate Action Network, Chevron, Conflict of Interest, Conflicts of Interest, Congressional Research Service, ConocoPhillips, DeSmogBlog, Disclosure, Energy, Environment, Environmental Resources Management, ERM, ExxonMobil, Federal Acquisition Regulation, Federal Government, Forecast the Facts, Friends of the Earth, Greenpeace, Harold Geisel, Huffington Post, Industry, John Kerry, Keystone XL, Koch Gateway Pipeline Company, Koch Industries, KXL, lobbying, Mother Jones, NC WARN, Oil Change International, politics, Public Citizen's Energy Program, Shell, State Department, Steve Koster, Tar Sands, Tom Zeller, TransCanada, Unitarian Universalist Ministry for Earth

View the original article here

Letter to Secretary of State John Kerry and State Dept. Deputy Inspector General Harold Geisel

Letter to Secretary of State John Kerry and State Dept. Deputy Inspector General Harold Geisel ERM’s Proposal to the State Department

ERM’s Proposal to the State Department So the question must be asked: If ERM is unable to accurately fill out a simple questionnaire regarding conflicts of interest, how can we trust the company to perform an unbiased environmental assessment of a 1,179 mile-long pipeline cutting through the American heartland? And, why did the State Department’s Contracting Officer not flag the inconsistencies in ERM’s Conflict of Interest Questionnaire when reviewing the proposals?

So the question must be asked: If ERM is unable to accurately fill out a simple questionnaire regarding conflicts of interest, how can we trust the company to perform an unbiased environmental assessment of a 1,179 mile-long pipeline cutting through the American heartland? And, why did the State Department’s Contracting Officer not flag the inconsistencies in ERM’s Conflict of Interest Questionnaire when reviewing the proposals?\ABS\Auto Blog Samurai\data\Land Rigs\checksandbalancesproject\80a23e5d-3b08-47e9-9c90-68466e287b45.jpeg) Harold Geisel, Deputy Inspector General, U.S. State Department

Harold Geisel, Deputy Inspector General, U.S. State Department

Benoit Ludot

Benoit Ludot

Laurent Stephane

Laurent Stephane