LONDON - BP PLC (BP.LN) may decide to shut down the Bruce natural gas field in the U.K. North Sea earlier than planned unless a way is found to restart production at the adjoining Rhum field, which is shutdown because of sanctions against Iran.

Without the inclusion of gas from Rhum, which could more than double the combined output of the fields, BP said it does not make commercial sense to keep running the older Bruce field, a BP spokesman said Tuesday. BP shut down production at Rhum in November 2010 due to Western sanctions that prohibit financial transactions with one of the field's joint owners, which is a unit of the National Iranian Oil Company.

Early decommissioning of any North Sea field would be a blow to the U.K. government, which has recently implemented a raft of tax breaks in an effort to bolster the country's energy security by keeping aging offshore oil and gas facilities operating. BP's warning comes just days after U.K. gas prices surged due to unseasonably cold weather, and unexpected production and pipeline outages.

A spokesman for the U.K. Department of Energy and Climate Change declined to comment on whether the government was doing anything to resolve the sanctions issue.

Referring to the possibility that BP and its partners may decide to bring forward decommissioning of Bruce, the spokesman said: "That's a commercial matter for BP and those involved."

The U.K.'s Foreign and Commonwealth Office declined to comment.

"The long-term future of the Bruce facilities is very closely tied to the ability to produce from Rhum. Given the uncertainties, we are considering what a decommissioning project would entail and how long it would take to execute," a BP spokesman said, without giving any further details.

Bruce, which started producing in 1993, is currently scheduled for decommissioning in the early 2020s, BP said. It produces 20,000 barrels of oil equivalent a day, two-thirds of which is gas.

Production started in 2005 at Rhum, which is connected to the Bruce platform via a sub-sea pipeline. Rhum was producing around 30,000 barrels of oil equivalent a day of natural gas when it was shuttered, BP said.

Finding a solution to the sanctions problem would not be without precedent. Last year, U.K. and European Union officials convinced some U.S. lawmakers to ensure that any new sanctions against Iran should exempt the $20 billion BP-led natural gas project, Shah Deniz, in the Caspian Sea off the coast of Azerbaijan. Another unit of the National Iranian Oil Company has a 10% stake in the project.

Europe sees Shah Deniz as vital to diversifying gas supplies so the region is not too dependent on Russian imports.

France's Total SA (TOT), Australia's BHP Billiton Ltd. (BHP) and Japanese trading house Marubeni are also shareholders in Bruce. Bruce is located about 340 kilometers northeast of Aberdeen.

Copyright (c) 2012 Dow Jones & Company, Inc.

Generated by readers, the comments included herein do not reflect the views and opinions of Rigzone. All comments are subject to editorial review. Off-topic, inappropriate or insulting comments will be removed.

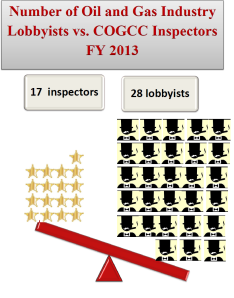

The report released this week by Colorado Ethics Watch found that the oil and gas industry has spent a whopping $4.7 million on lobbyists from Fiscal Years 2008-09 through 2011-12 – more than any other industry in Colorado except the health care industry.

The report released this week by Colorado Ethics Watch found that the oil and gas industry has spent a whopping $4.7 million on lobbyists from Fiscal Years 2008-09 through 2011-12 – more than any other industry in Colorado except the health care industry. The American public was supposed to get an honest look at the impacts of the Keystone XL pipeline. Instead, Environmental Resources Management (ERM), a fossil fuel contractor, hid its ties from the State Department so they could green light the project on behalf of its oil company clients.

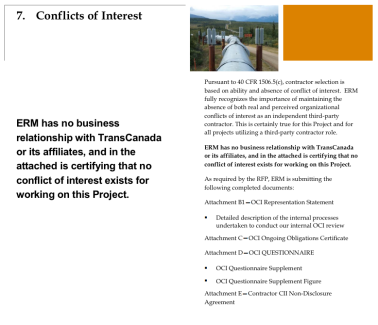

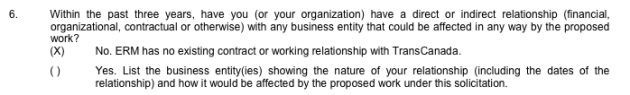

The American public was supposed to get an honest look at the impacts of the Keystone XL pipeline. Instead, Environmental Resources Management (ERM), a fossil fuel contractor, hid its ties from the State Department so they could green light the project on behalf of its oil company clients.

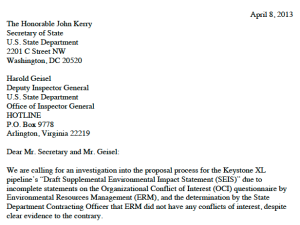

Because of the issues above, Checks & Balances Project (C&BP) and 11 environmental, faith-based and public interest organizations sent a letter [.PDF] on April 8, 2013, calling on Secretary of State John Kerry and the State Department Deputy Inspector General Harold Geisel to investigate two things: first, whether ERM hid conflicts of interest which might have excluded it from performing the Keystone XL environmental assessment and second, how State Department officials failed to flag inconsistencies in ERM’s proposal.

Because of the issues above, Checks & Balances Project (C&BP) and 11 environmental, faith-based and public interest organizations sent a letter [.PDF] on April 8, 2013, calling on Secretary of State John Kerry and the State Department Deputy Inspector General Harold Geisel to investigate two things: first, whether ERM hid conflicts of interest which might have excluded it from performing the Keystone XL environmental assessment and second, how State Department officials failed to flag inconsistencies in ERM’s proposal.